North West businesses take slice of £80m NPIF II funding in first year since launch

April 2025 – In its first year since launching, the Northern Powerhouse Investment Fund II (NPIF II) has successfully completed over 200 investments into small businesses across the North of England, totalling over £80m. The investments, delivered by the NPIF II fund managers, have assisted in driving sustainable economic growth by supporting innovation and local opportunities for new and growing businesses across the North.

Praetura, FW Capital, River Capital and GC Business Finance are responsible for delivering NPIF II funds across the North West, enabling ambitious businesses to access small loans, debt, and equity finance options.

Operated by the British Business Bank, NPIF II is a £660m fund that provides loans and equity finance options for Northern smaller businesses that might otherwise not receive investment. The purpose of NPIF II is to break down barriers in access to finance by providing loans from £25k to £2m and equity investment up to £5m to start up, scale up, and stay ahead.

Building on from the success of the first Northern Powerhouse Investment Fund which launched in 2017, NPIF II was extended to encompass the entirety of the North of England by expanding its reach to cover the whole of the North East.

In its first year in operation, NPIF II has delivered investment to a range of smaller businesses, supporting them in achieving their growth objectives.

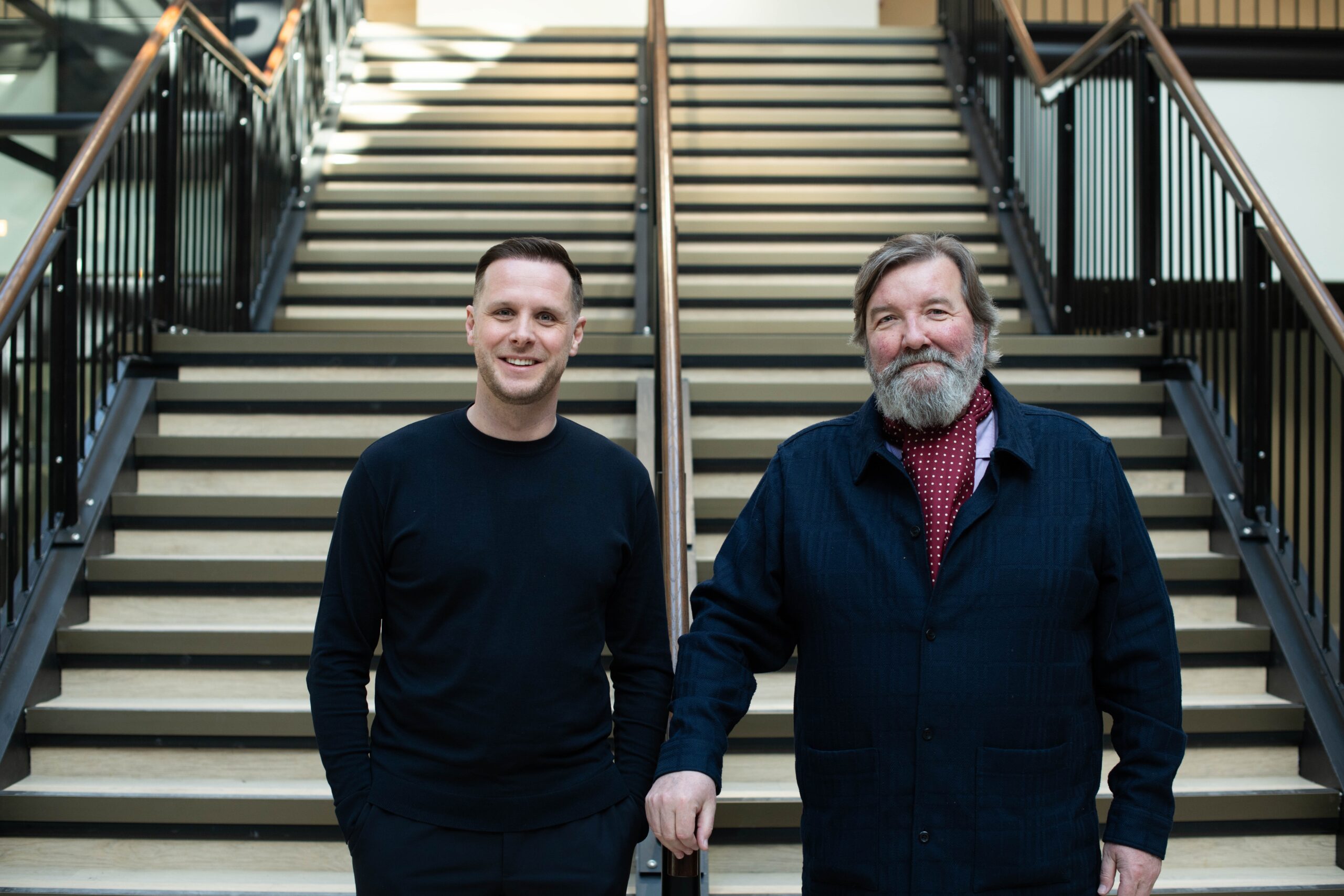

Lancashire-based independent gaming studio, Play XD Ltd, secured funding from NPIF II – River Capital and GC Business Finance Smaller Loans to support its growth plans as it develops its latest gaming titles in partnership with tech giant, meta. The NPIF II investment will support the creation of nine new skilled jobs in Lancashire, including roles for producers, programmers, artists, and marketing professionals as the company works towards its scheduled launch of virtual reality game Primal Rumble in Q2 2026 on the Meta Quest platform.

Over in Merseyside, Knowsley’s Central Group secured £700,000 from NPIF II – FW Capital Debt Finance to accelerate innovation and create eight new jobs. The funding is driving its collaboration with the University of Liverpool and Liverpool John Moores University on a Knowledge Transfer Project, focused on AI-powered diagnostics and maintenance. With NPIF II support, Central Group is advancing next-gen technology to enhance performance and reliability in industrial drive systems.

Taking advantage of the fast-growing racquet game, The Padel Club raised £1.5m in funding from NPIF II – Praetura Equity Finance in one of the first deals for NPIF II in the North West. The deal helped supercharge its growth plans which has led to the opening of its new site in Trafford City last month, which will be home to 11 courts.

Sue Barnard, senior investment manager at the British Business Bank, said: “With thousands of new businesses launching in the North in 2024, the region is full of ambitious and driven entrepreneurs and NPIF II is helping them to take their businesses to the next level. From a thriving gaming company like Play XD in Lancashire to Knowsley-based electromechanical specialist Central Group, and The Padel Club in Cheshire bringing an up-and-coming sport to the region, we’re backing businesses with big ideas and strong local roots.

“More than £80 million has already been invested across the North in NPIF II’s first year, and that early momentum shows just how much appetite there is for growth. It’s been especially rewarding to support businesses leading the way in innovation, sustainability, and inclusivity and there’s so much more to come.”

Commenting on the one-year milestone, Adam Kelly, Managing Director, Co-Head of Funds at the British Business Bank, said: “Our focus has always been towards helping smaller businesses achieve their ambitions by gaining transformational access to finance. From padel courts to cafes launching products in national stores, the Northern Powerhouse Investment Fund II has done exactly that by empowering local business leaders and entrepreneurs to grow their organisations.

“In its first year, over £80m invested into the Northern economy is a fantastic feat, and we’re proud to have supported North West-based businesses at the forefront of innovation, or building the modern, green economy, and those led by underrepresented founders. This is only the first year of NPIF II and there are still so many great businesses out there looking for investment.”

The purpose of the Northern Powerhouse Investment Fund II is to drive sustainable economic growth by supporting innovation and creating local opportunity for new and growing businesses across the North. The Northern Powerhouse Investment Fund II will increase the supply and diversity of early-stage finance for Northern smaller businesses, providing funds to firms that might otherwise not receive investment and help to break down barriers in access to finance.