River Capital backs Moxie Financials with £50k NPIF II investment

Press Release: River Capital has announced a £50,000 investment in Simplify Business Services Limited, trading as Moxie Financials. The funding comes from NPIF II – River Capital & GC Business Finance Smaller Loans, which is managed by the consortium as part of the Northern Powerhouse Investment Fund II.

The investment will support the Preston based accountancy firm’s ambitious growth plans and create at least four new jobs over the next two years.

Founded in October 2022 by ACA-qualified accountant Sian How, Moxie Financials is transforming how UK SMEs engage with accounting services. The company bridges the critical gap between traditional compliance focused accounting and strategic financial leadership by offering a comprehensive solution that combines outsourced daily financial management with high level strategic guidance.

The loan will provide essential working capital for Moxie Financials to expand its team, with immediate plans to hire an additional accountant and a tax specialist later this year. This will allow Sian to focus more on business development and client acquisition.

Primarily serving professional services firms, creative agencies, and technology companies that have moved beyond their start-up phase but haven’t yet built a full finance function, the company has been particularly successful with legal firms, recruiters, events companies, and solicitors. It plans to intensify marketing efforts toward the legal sector.

Sian How, Director of Moxie Financials, said: “This investment comes at a pivotal time for us. We’ve been gaining momentum with new clients signing up each month, and this funding will allow us to scale our team to meet this growing demand while maintaining our high service standards.”

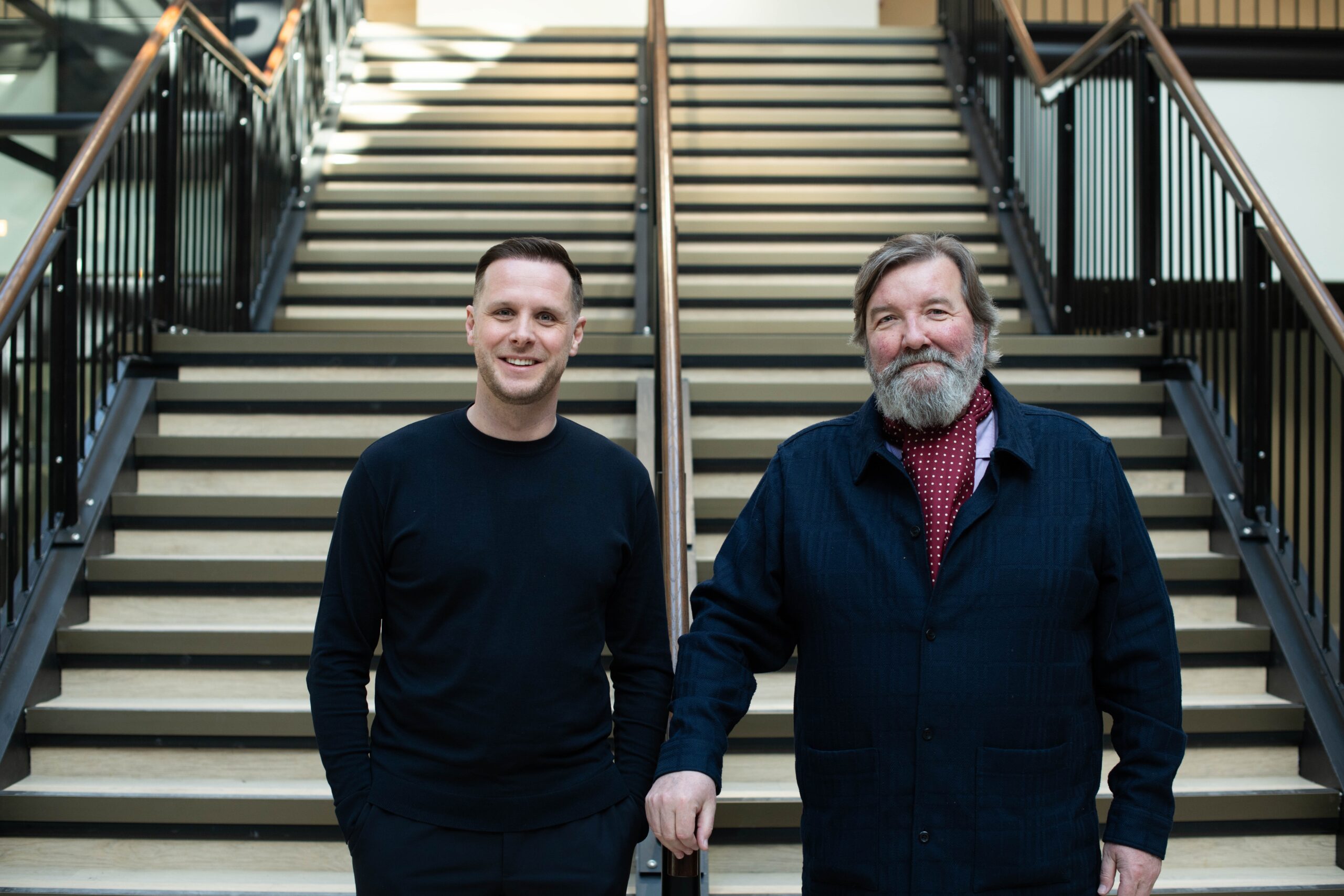

River Capital investment manager Sue Chambers said: “Moxie Financials represents exactly the type of innovative business we aim to support through the Northern Powerhouse Investment Fund II. Their unique approach to providing ‘big accountancy for small businesses’ addresses a clear market need and Sian has already demonstrated strong traction with clients across the region.”

Sue Barnard, senior manager at the British Business Bank, said: “Through NPIF II, we’re committed to helping ambitious businesses like Moxie Financials access the capital they need to scale and grow. The investment from River Capital will support the creation of new skilled jobs in the North West and enable the business to continue delivering high impact financial leadership to growing SMEs. Moxie Financials is a great example of how NPIF II is helping innovative companies turn potential into results.”

The £660m Northern Powerhouse Investment Fund II (NPIFII) covers the entire North of England and provides loans from £25k to £2m and equity investment up to £5m to help a range of small and medium sized businesses to start up, scale up or stay ahead.

The purpose of the Northern Powerhouse Investment Fund II is to drive sustainable economic growth by supporting innovation and creating local opportunity for new and growing businesses across the North of England. The Northern Powerhouse Investment Fund II will increase the supply and diversity of early-stage finance for the North’s smaller businesses, providing funds to firms that might otherwise not receive investment and help to break down barriers in access to finance.