fund:AI is the North’s first dedicated AI, Machine Learning and Data Science Fund.

Artificial Intelligence is one of the most significant emerging trends in the UK. The UK ranks first in Europe and third globally in developing AI technology. Our team have deep sector experience in Data rich businesses having invested, advised, and founded some of the North’s most important ‘unicorn’ and ‘futurecorn’ AI companies.

fund:AI is an EIS growth fund that will provide investors with access to a unique selection of innovative growth AI companies or tech enabled companies with big data sets. It is intended for investors who want to achieve capital growth (rather than income) by investing early-stage, unquoted companies which have the potential to increase in value significantly.

fund:AI will invest development capital to businesses seeking to accelerate their growth or build out their platform. This includes:

- Launch and expansion of products

- Creation and expansion of data science teams

- Creation of IP/Product from un-tapped big data sets

80% of our investments will be in our target territories of the North West of England, North Wales and West Yorkshire. The Midlands and North East of England are also included within our target geographies.

As an ‘Evergreen’ Fund, fund:AI will have two ‘soft closes’ per annum. Each ‘soft close’ will be in March and September. The fund is an Enterprise Investment Scheme which was introduced by the Government via the Finance Act 1994. Investors will be able to claim EIS reliefs with a taxable date matching the date the funds are invested into the underlying invest companies.

It is recommend that prospective Investors seek independent advice to ensure that they fully understand how any tax advantages may apply to their situation and circumstances. Tax treatment depends on the individual circumstances of each investor and may be subject to legislative or other changes in the future. River Capital does not give tax advice and prospective investors should consult a tax or other suitably qualified advisor to discuss their personal circumstances.

For more information contact us at investor.relations@rivercapitaluk.com or click here

Find out more about AI with David Walters and Martin Sutton

Meet Fallen Planet

At a glance

EIS Frequently Asked Questions

The EIS scheme was introduced in 1994 by the government as a way of helping early-stage businesses grow and access venture capital. EIS businesses can raise up to £5 million each year and a maximum of £12 million in their lifetime through the scheme.

One of the biggest benefits of investing in EIS is an income tax relief of up to 30%.

Yes. Below you’ll find a list of additional EIS benefits that you can take advantage of with River Capital.

Capital Gains Tax Exemption

Investors are exempt from Capital Gains Tax realised on the disposal of EIS-qualifying shares, providing the shares were held for at least three years.

Inheritance Tax Relief

Under Business Property Relief, EIS shares which have been held for at least two years will qualify for Inheritance Tax Relief, providing the shares are in a ‘trading company’ and are still owned at the date of death. No upper limit is applied to the claimable amount of Inheritance Tax Relief.

Capital Gains Tax Deferral

When investors dispose of an asset and make a gain, CGT is typically payable on the gain for the tax year in which the disposal arose. Deferral relief allows investors to treat the gain as not arising until some time in the future – if you acquire EIS shares. To claim deferral relief the investor must invest an amount equal to the chargeable gain.

Loss Relief

If shares in an EIS company are disposed of at a loss, investors can offset this loss against capital tax or income tax (at their marginal rate).

EIS businesses must be UK-based and not trading on a recognised stock exchange. They tend to be privately owned seed and early-stage businesses that have no more than £15 million in gross assets when shares are issued and no more than £16 million immediately after.

The companies we focus on are often B2B and occupy future-focused industries, including AI, Machine Learning and Data Science.

EIS Want To Find Out More?

EIS Want To Find Out More?

Product Terms

Thank you for your interest in River Capital Limited products and services. As a UK fund Manager, we are required by our regulator the Financial Conduct Authority to have in place safeguards to prevent investment in our funds by anyone without the financial capacity to withstand potential loss or the understanding of the risks involved.

If, after reading the important risk warning above, you would like to know more about us and the companies we back, please complete the following short form and a member of our Client Services Team will get back to you.

Meet our expert AI team:

David Walters

Investment Director0151 236 4040

Investment Director

david.walters@rivercapitaluk.com

0151 236 4040

What is my role?

I work in the Equity Team as a Technology Investment Director and support technology businesses across the region. I have also operated as a CTO at multiple PE backed companies and have also run AI practices. Data and Artificial Intelligence is my superpower and I am a member of the DataIQ 100.

Hobbies or interests outside of work?

- I collect and restore classic Italian scooters

- I play the guitar

- I support the mighty Tranmere Rovers.

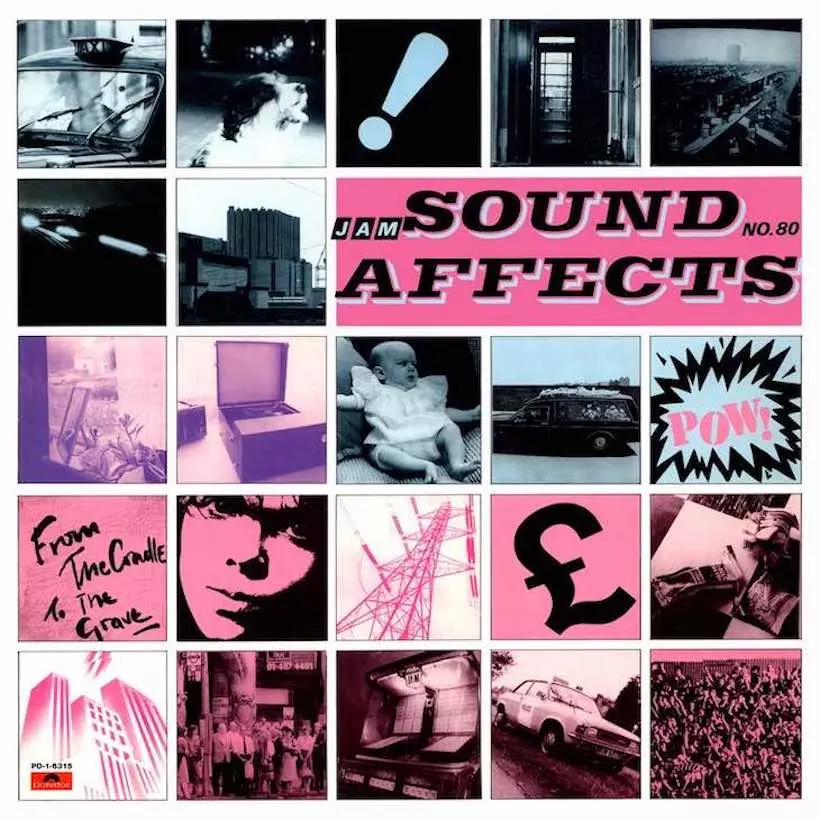

Favourite album?

Sound Affects by The Jam.

Dr Marc d’Abbadie

Head of Venture & COO0151 236 4040

Head of Venture & COO

marc.dabbadie@rivercapitaluk.com

0151 236 4040

What is my role?

I am proud to look after River’s Equity practice as well our Operations and Compliance.

Hobbies or interests outside of work?

- Tango

- Cooking

- Swimming.

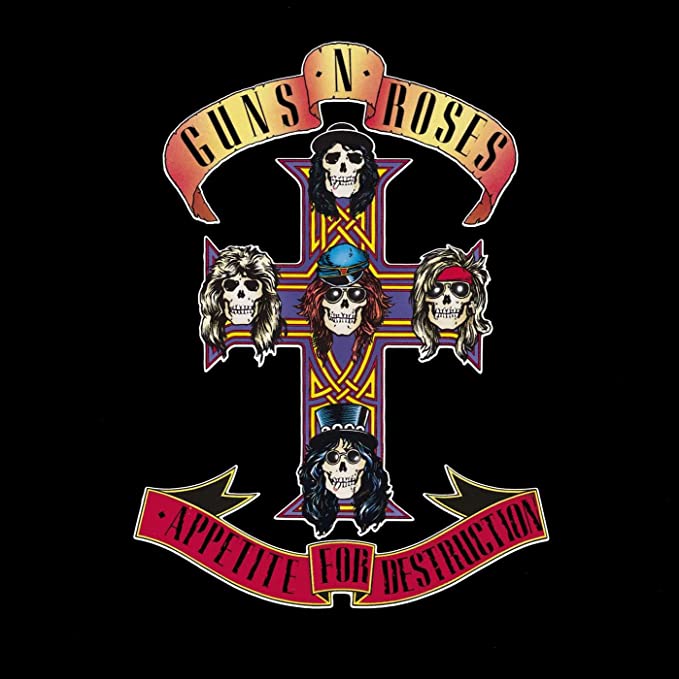

Favourite album?

Appetite for Destruction by Guns n’ Roses.

Martin Sutton

Venture Partner0151 236 4040

Venture Partner

martin.sutton@rivercapitaluk.com

0151 236 4040

My Role:

- Being outdoors either running or walking in the lakes with Lenny our Airedale Terrier followed by a pint of Guinness in a proper pub with a few mates.

- I’m also a bit of an anorak for older air-cooled Porsches.

Favourite album:

Plastic Beach by Gorillaz

Chris Hood

Retail Operations Director0151 236 4040

Retail Operations Director

0151 236 4040

What is my role?

As Retail Operations Director I work closely with Financial Advisers/Intermediaries to enable clients to invest in appropriate Tax Wrappers such as the River Capital AI Enterprise Investment Scheme.

Hobbies or interests outside of work?

Supporting Liverpool Football Club

Keeping Fit by playing various sports

Travelling

Fave album?

Back In Black AC/DC