Venture Capital (VC) is a form of private equity and a type of financing that investors provide to start-up companies and ambitious businesses that are believed to have exceptional growth potential.

In exchange for an equity stake, venture capitalists invest in high growth businesses. These include new ventures, start-ups and scale-ups often following on from seed funding.

Businesses can receive Venture Capital funding throughout the early and middle stages of their growth cycle. This can be staged over a series of multiple funding rounds, allowing businesses to fundraise.

What is Venture Capital Funding?

Key Characteristics

Venture Capital is high risk, high reward investing. It can back outstanding companies, even if there is risk remaining or if there is the potential for exceptional returns.

Venture Capitalists buy a part of your business. They become co-owners like you.

Venture Capital is a long-term financial solution, with most firms planning for an exit within 5-7 years.

To provide the Venture Capitalist with an exit, you will generally need to either sell your company (to another company or another investor) or to list it on the stock market

It is usual that as well as funding, Venture Capitalists offers an additional layer of support for entrepreneurs, for instance by appointing a Non-Executive Director to the Board who can add value to the business

Fund:AI

Delivered by River Capital, fund:AI is the North’s first dedicated artificial intelligence fund, providing investment into businesses utilising AI, machine learning and large data science sets.

Fund:AI Key characteristics:

- The North’s first dedicated AI, Machine Learning and Data Science Fund.

- Enterprise Investment Scheme open to private investors.

- 80% of investments will be in the North.

- Typical investment – £500k to £2m, ideally syndicated with other investors.

Apply for fund:AI Investment

Our team are on hand to answer any questions

Our team are on hand to answer any questions. Feel free to get in touch to discuss your business plans and apply for Venture Capital funding by filling in our online application form.

Interested in investing in fund:AI

If you’re interested in finding out more about investing in fund:AI, get in touch now to speak to one of our expert team members.

Who are you?

Springpod

Springpod is a specialist careers platform enabling young people to experience the world of work and university at an early stage, online.

£500,000 Invested

Legacy

River Capital has successfully invested four previous Venture Capital funds including Venture Fund 1 in 1996, Venture Fund 3 in 2001, Liverpool Seed Fund (2005) and Merseyside Loan and Equity, a mixed strategy fund that includes venture in 2008.

Each fund has supported a number of businesses with early-stage capital to support their growth journey before eventually completing a successful exit. With dedicated portfolio managers working alongside, we pride ourselves on working closely with each investment to ensure a successful outcome.

Regional Growth

Investment Range

Tailored venture investment between £500,000 and £2million, but with capacity to co-invest alongside other funds.

Geographical focus

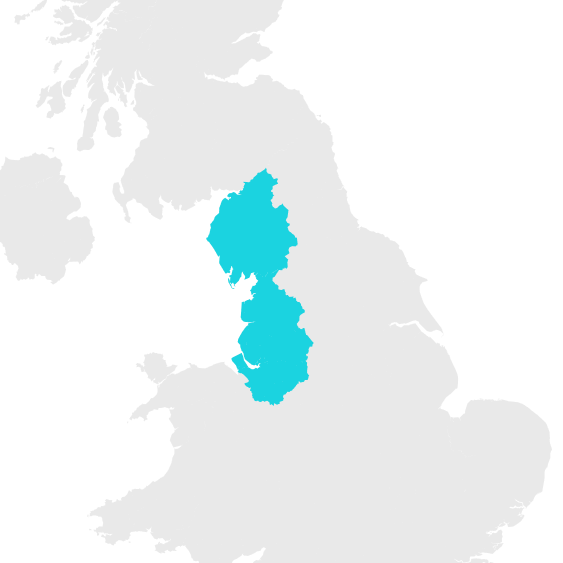

Supporting businesses operating across the North West

Funding inclusivity

Focusing on elevating business diversity, equity and inclusion (DEI), welcoming applications from all sectors, especially from underrepresented networks like female founders.

Start your journey with Venture Capital Funding by River Capital

Fuelling ambition together.

With our expertise, experience, and our deep understanding of the North West market we know the challenges and opportunities faced by founders across the region. River Capital isn’t just an investor; we are partners committed to supporting your growth journey.

Why Choose us?

We’ve proven we can deliver time and time again.

Through our people, expertise and skills we bring the energy, passion and opportunity to businesses seeking to grow, prosper and achieve their goals.

We are dedicated to supporting businesses across the North West, providing more than just capital. We develop long lasting partnerships, back good people and provide access to vast networks of like-minded professionals to help you achieve your business ambitions.